Introduction to the Stock Market

Welcome to the exciting world of the stock market! Whether you are an experienced investor or just beginning your financial journey, it is important to know 5 things before the stock market opens. In this blog section, we will explore the fascinating realm of stocks and shares, delving into what drives them and why they are so appealing to people all over the world.

The stock market is similar to a busy marketplace where companies trade their shares, giving investors a chance to own a portion of those businesses. It is not solely about making profits; it is also about being involved in something bigger – supporting companies that you have faith in while potentially gaining financial benefits.

However, be cautious: investing in stocks carries a certain level of risk. The prices can fluctuate greatly; they can increase and decrease with each change in the economic environment. It is crucial to comprehend these risks before fully committing to any investment plan.

Lastly, it is important to maintain realistic expectations. While some may experience overnight success in the stock market, most successful investors build their wealth over time through careful planning and discipline. So get ready for an exciting journey as we explore these “5 things to know before the stock market opens” together!

Importance of Knowing Before Market Opens

Imagine this: You wake up, pour yourself a cup of coffee, and eagerly sit down to begin your day. As an investor or trader, there is something energising about the hours before the stock market opens. Why? Because these pre-market moments can have a significant impact.

Firstly, being informed before the market opens enables you to quickly respond to breaking news and events that may affect your investments. From economic reports to geopolitical developments, having knowledge is crucial in making well-informed decisions that could have a positive impact on your portfolio.

In addition, preparing before the market opens gives you a significant advantage over other traders. While some may still be in bed, you are gathering information on important corporate announcements or earnings releases from companies overnight. It’s like being ahead of the game on the trading floor while others are scrambling to catch up.

Furthermore, having an understanding of global events during these early hours enables you to better comprehend market sentiment. News originating from Asia or Europe may have already impacted futures markets and established expectations for the upcoming U.S. trading session.

Finally, gaining insights into pre-market movements can help improve your strategies for both short-term trades and long-term investments. By analysing trends or identifying potential discrepancies between fair value price and after-hours pricing adjustments, you position yourself advantageously for success.

5 Things to Know Before the Stock Market Opens:

We discuss the five essential things you need to know before diving into the exciting world of stock market trading. We will be focusing on five crucial aspects that can greatly impact your trading day: the Economic Calendar and Upcoming Events, Pre-Market News and Analysis, Overnight Market Movement, Key Technical Levels and Indicators to Watch and Your Trading Plan & Goals for the Day.

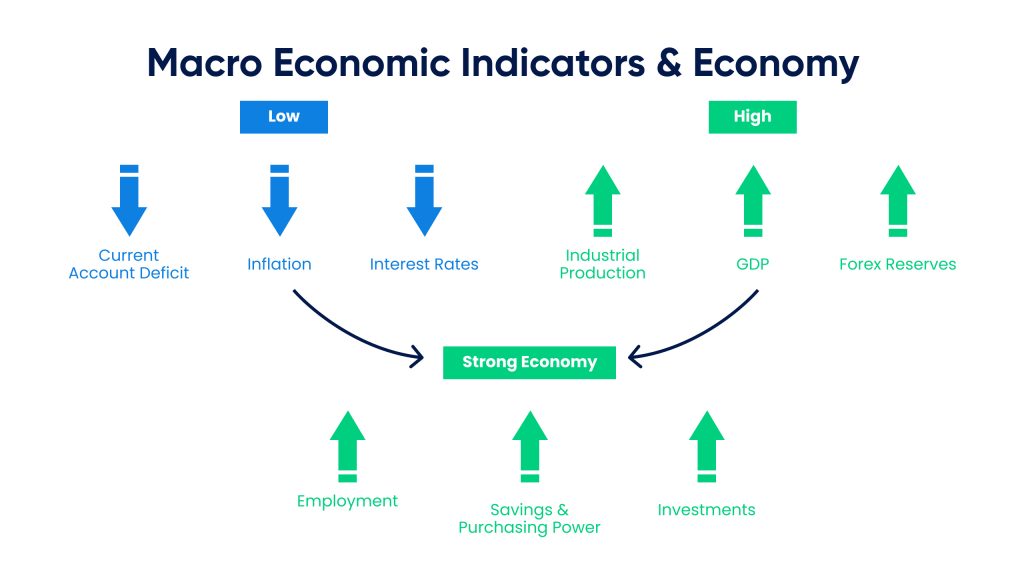

Economic Calendar and Upcoming Events

First, let’s explore the Economic Calendar and Upcoming Events. Stay informed about any important economic reports or data releases scheduled for today. These events can greatly influence market sentiment, so be sure to pay attention to key indicators such as employment figures, GDP revisions, or central bank statements.

Pre-Market News and Analysis

The next item is Pre-Market News and Analysis, which will assist in setting the tone for your day. By gaining insight into pre-market activity, you can uncover early indications of potential movers and shakers in different sectors. Keep an eye out for both company-specific news, such as earnings releases or product launches, as well as broader market trends that may influence investor sentiment.

Overnight Market Movements

Do not overlook overnight market movements. While you were sleeping, global markets were actively influencing today’s trading session. Take note of how international indices performed overnight, as there is often a strong connection between world markets. Also consider how geopolitical events may affect investors’ willingness to take risks as they begin trading in the United States.

Key Technical Levels and Indicators to Watch

It is essential for any trader or investor to understand technical analysis. As the market opens, it is important to keep an eye on key support and resistance levels that may impact price movements throughout the day. Furthermore, monitoring popular indicators such as moving averages or MACD can provide valuable signals about potential trends.

Your Trading Plan and Goals for the day

Before immersing yourself in the fast-paced world of trading, it is crucial to have a well-developed plan.

Define your daily objectives:

Are you seeking immediate profits through short-term trades?

Or are you prioritising long-term investments?

Having a distinct vision will aid in maintaining discipline during market fluctuations.

In addition to your overall trading strategy, it is important to set specific daily goals in order to track progress and maintain motivation as a trader. It is important to be realistic about the level of profits or losses you hope to achieve by the end of the trading day.

Tips for Utilising This Knowledge Effectively

Now that you have the essential knowledge to navigate the stock market before it opens, let’s delve into some tips on how to effectively make use of this information. Remember, understanding these five things is only half the battle; strategically implementing them is what distinguishes successful traders and investors.

Analyse your Portfolio

Examine your current investments carefully and evaluate how they correspond with the information presented in this article. Do you need to make any changes or rebalance your portfolio to maximise your positions? Think about whether you should sell certain stocks or if there are new opportunities arising from pre-market developments.

Develop a Pre-Market Routine

Creating a pre-market routine can assist in streamlining your decision-making process and reducing impulsive actions influenced by last-minute news or rumours. It may be beneficial to review major indices, scan the performance of foreign markets overnight, and identify key levels of support and resistance.

Timing is Key

Knowing when to execute your trades can greatly affect your returns. Monitor market timings closely and take note of pre-market and after-hours trading. Predicting market trends ahead of time could give you an advantage.

Diversify intelligently

With an understanding of the different sectors that may be affected by specific events, it is important to strategically diversify your investment portfolio across industries. This will help to minimise risk while maximising potential gains in various areas of the market.

Leverage Technical Tools

Take advantage of technological advancements by using trading platforms like TradingView and apps that provide real-time data feeds and advanced charting capabilities during pre-market hours. This will allow you to gain insights into price movement patterns or unusual trading activity, which can provide valuable cues for your trades.

Common Mistakes to Avoid When Entering the Market in the Morning

The early morning hours of the stock market can be chaotic, with a lot of energy and opportunities. However, it is also a time when many traders make critical errors that can greatly affect their performance for the day. Therefore, before you jump into the market frenzy, here are some common mistakes to avoid:

Neglecting Pre-Market Research

Proper preparation is crucial for achieving success in trading. Neglecting to do your due diligence, such as reviewing overnight news or scanning pre-market data, could result in being caught off guard by unforeseen events.

Trading without a Plan

Entering the market without a clearly defined strategy is similar to navigating through a maze while blindfolded – you will probably become lost and disoriented. Having a thorough plan based on careful analysis not only offers direction, but also helps to maintain discipline during chaotic situations.

Overreacting to Volatility

It is not a secret that markets can experience volatile fluctuations, especially during early morning trading sessions. Acting impulsively out of fear or greed in response to sudden price changes often results in unfavourable outcomes.

Ignoring stop-loss Orders

Allowing emotions to override your predetermined exit points is asking for trouble. Utilising stop-loss orders ensures that you limit potential losses and protect your capital from devastating blows.

Clinging onto losing trades

Recognising when an investment is not going as planned requires humility and prompt action; holding onto failing positions in hopes of a miraculous recovery rarely ends well.

Conclusion

As the saying goes, knowledge is power. This statement holds true when it comes to investing in the stock market. By being aware of these five key factors before the market opens, you can make more informed and strategic investment decisions. Whether it’s understanding market trends or keeping up with company news, staying informed is crucial for success in the stock market. So remember these tips and continue to educate yourself on all things related to investing – your portfolio will thank you!

Check out more content like this!